On July 18, 2025 the Income Tax Department said that Income Tax Audit using Forms 3CA-3CD and 3CB-3CD are now enabled on the e-Filing ITR portal with many changes. Moreover, the tax department has also released the common offline utility functionality of income tax audit forms Form 3CA, Form 3CB and Form 3CD.

Regarding the changes made in the respective tax audit forms the Income Tax Department released a separate schema change document which lists out a total of 71 changes that have been made in the respective tax audit forms. (35 in Form 3CA-3CD and 36 in Form 3CB-3CD).

The deadline for filing a tax audit report using the respective forms remains unchanged – September 30, 2025 for FY 2024-25 (AY 2025-26). Once the tax audit report is filed, taxpayers are required to file an income tax return (ITR) on or before October 31, 2025.

Tax audit is a mandatory requirement for those taxpayers who have a specified income level from business or profession heads of income and is required to maintain a books of accounts.

What are some of the changes made in the income tax audit forms for FY 2024-25 (AY 2025-26)?

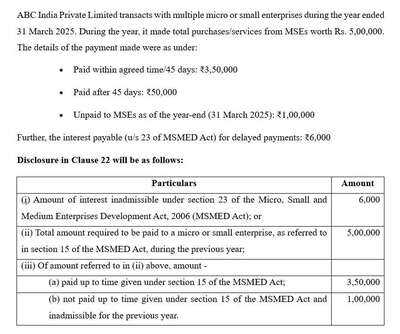

Chartered Accountant Ashish Karundia explains that in the tax audit form-3CD, clause 22 has been updated to strengthen disclosure requirements related to payments made to micro or small enterprises, as well as the interest that is not allowable as a deduction.

The table below explains the two main changes made in clause 22 of tax audit Form 3CD:

Source: Ashish Karundia

Karundia says: “In summary, sub-clause iii (b) covers payments that meet both of the following criteria: they are made after the deadline under Section 15, and they are not allowed as deductions for the relevant financial year.”

Karundia explains using an example how the disclosure in Clause 22 will be:

As per Chartered Accountant Gaurav Makhjiani, Head of Tax, Roedl and Partners, the changes in the Tax Audit Report are as under :

1. Clause 12: Requires reporting of income assessable on a presumptive basis. This clause has been amended to include reporting under Section 44BBC, which provides a special provision for computing the business income of non-resident cruise ship operators. Introduced via the Finance Act, 2024, this section deems 20% of the aggregate of specified amounts as taxable business income.

2. Clause 19: Deals with the reporting of deductions. From this year, the form omits the fields for deductions under Section 32AC (investment in new plant and machinery), Section 32AD (investment in notified backwards areas), Section 35AC (expenditure on eligible projects), and Section 35CCB (expenditure on agro-based programs). These sections are now redundant and not applicable for AY 2025–26; hence, the corresponding reporting requirement has been removed.

3. Clause 21: Pertains to the reporting of expenses that are not allowable as deductions. As per the Finance Act, 2024, any expenditure related to regulatory violations or settlements is not tax-deductible. Such expenses are now required to be disclosed under this clause.

4. Clauses 28 and 29: Previously required reporting under Sections 56(2)(viia) and 56(2)(viib) has been deleted. This follows the removal of these provisions under the Finance Act, 2024.

6. The utility for the Tax Audit Report will now feature a drop-down selection. This allows clear and less confusing reporting.

7. A new clause, Clause 36B, has been introduced to report details of share buybacks. This follows the amendment under the Finance Act last year, which provides that buybacks of shares will also be taxable as dividend. The clause requires reporting of:

Chartered Accountant Ashish Niraj, Partner, A S N & Company, lists out five changes in the respective tax audit forms for AY 2025-26:

What is a common offline utility for income tax audit form Form 3CA-3CD and 3CB-3CD?

Chartered Accountant Himank Singla, partner, SBHS & Associates, explains:

What are the various types of tax audit forms and which form is used for which purpose?

According to the Income Tax Department website, you need to install Microsoft Edge browser before installing the common tax audit utility.

According to the Income Tax Department website, the tax audit forms are:

Singla explains:

According to Soni from Tax2Win these need to get a tax audit done:

Regarding the changes made in the respective tax audit forms the Income Tax Department released a separate schema change document which lists out a total of 71 changes that have been made in the respective tax audit forms. (35 in Form 3CA-3CD and 36 in Form 3CB-3CD).

The deadline for filing a tax audit report using the respective forms remains unchanged – September 30, 2025 for FY 2024-25 (AY 2025-26). Once the tax audit report is filed, taxpayers are required to file an income tax return (ITR) on or before October 31, 2025.

Tax audit is a mandatory requirement for those taxpayers who have a specified income level from business or profession heads of income and is required to maintain a books of accounts.

What are some of the changes made in the income tax audit forms for FY 2024-25 (AY 2025-26)?

Chartered Accountant Ashish Karundia explains that in the tax audit form-3CD, clause 22 has been updated to strengthen disclosure requirements related to payments made to micro or small enterprises, as well as the interest that is not allowable as a deduction.

The table below explains the two main changes made in clause 22 of tax audit Form 3CD:

Source: Ashish Karundia

Karundia says: “In summary, sub-clause iii (b) covers payments that meet both of the following criteria: they are made after the deadline under Section 15, and they are not allowed as deductions for the relevant financial year.”

Karundia explains using an example how the disclosure in Clause 22 will be:

As per Chartered Accountant Gaurav Makhjiani, Head of Tax, Roedl and Partners, the changes in the Tax Audit Report are as under :

1. Clause 12: Requires reporting of income assessable on a presumptive basis. This clause has been amended to include reporting under Section 44BBC, which provides a special provision for computing the business income of non-resident cruise ship operators. Introduced via the Finance Act, 2024, this section deems 20% of the aggregate of specified amounts as taxable business income.

2. Clause 19: Deals with the reporting of deductions. From this year, the form omits the fields for deductions under Section 32AC (investment in new plant and machinery), Section 32AD (investment in notified backwards areas), Section 35AC (expenditure on eligible projects), and Section 35CCB (expenditure on agro-based programs). These sections are now redundant and not applicable for AY 2025–26; hence, the corresponding reporting requirement has been removed.

3. Clause 21: Pertains to the reporting of expenses that are not allowable as deductions. As per the Finance Act, 2024, any expenditure related to regulatory violations or settlements is not tax-deductible. Such expenses are now required to be disclosed under this clause.

4. Clauses 28 and 29: Previously required reporting under Sections 56(2)(viia) and 56(2)(viib) has been deleted. This follows the removal of these provisions under the Finance Act, 2024.

6. The utility for the Tax Audit Report will now feature a drop-down selection. This allows clear and less confusing reporting.

7. A new clause, Clause 36B, has been introduced to report details of share buybacks. This follows the amendment under the Finance Act last year, which provides that buybacks of shares will also be taxable as dividend. The clause requires reporting of:

- The amount received from the buybacks

- The cost of acquisition of the shares

Chartered Accountant Ashish Niraj, Partner, A S N & Company, lists out five changes in the respective tax audit forms for AY 2025-26:

- In clause 12, Section 44BBC for presumptive taxation for non resident cruise ship operators added,

- In clause 21 Settlement expenses column reporting enabled so that these expenses can be disallowed as per changed law,

- In Clause 22 for MSME disclosures for payments made or not made within stipulated time has been segregated ,clause (iii)(b) has been modified, also clause (ii) and New field clause (iii)(a) added. In clause 26 43Bh added,

- In Clause 29 – the element tag has been modified from mandatory to optional and will be omitted from AY2025-26 onwards,

- In Clause 31 a regarding categorisation of loan or deposits, a new field clause (vii)(a) and (vii)(b) has been added for nature and account payee or not reporting.

What is a common offline utility for income tax audit form Form 3CA-3CD and 3CB-3CD?

Chartered Accountant Himank Singla, partner, SBHS & Associates, explains:

- The Income Tax Department’s offline common utility for various tax audit forms is a downloadable software that allows detailed entry of audit particulars, clause-by-clause validations, and ultimately generates a JSON file.

- This JSON file is then uploaded on the e-filing ITR portal and digitally verified by both the auditor and the taxpayer (assessee).

- Though the e-filing ITR portal provides an ‘online utility’ for income tax audit forms that allows users to fill the tax audit forms directly on the website interface, it is highly impractical for real-world usage. The system lacks robustness, often suffers from session timeouts, does not handle bulk data entry well, and provides no draft-saving or rollback facility.

- For medium to large audits, where the income tax audit Form 3CD may run into multiple pages with quantitative details, multiple depreciation blocks, and numerous clause-wise disclosures, direct online data entry is not only inefficient but also risky.

- Therefore, while the end process is online by nature of being filed on the portal, the groundwork remains firmly offline.

What are the various types of tax audit forms and which form is used for which purpose?

According to the Income Tax Department website, you need to install Microsoft Edge browser before installing the common tax audit utility.

According to the Income Tax Department website, the tax audit forms are:

- Form 3CA-3CD: Audit report under section 44AB of the Income -tax Act, 1961, in a case where the accounts of the business or profession of a person have been audited under any other law and Statement of Particulars required to be furnished under Section 44AB of the Income-tax Act, 1961.

- Form 3CB-3CD: Audit report under section 44AB of the Income -tax Act 1961, in the case of a person referred to in clause (b) of sub - rule (1) of rule 6G and Statement of Particulars required to be furnished under Section 44AB of the Income-tax Act, 1961.

Source: Tax2Win

Singla explains:

- With the release of Schema Version 2.2 for Form 3CB-3CD today on 17th July 2025, the Income Tax Department has brought in significant and technically dense modifications that every tax auditor must immediately adapt to.

- If a practitioner is unknowingly using an older offline utility, even one just a few months old, the system will outright reject the JSON file with cryptic errors like ‘schema mismatch’, causing unnecessary delays during peak compliance season.

- More substantively, new fields have been added under Clause 36B to capture specific amounts received, with Amount Recieved and Amount Recieved now mandatory in certain scenarios - a clause that never existed in earlier years and may catch many unaware.

- Equally important is the overhaul of Clause 31, which deals with reporting of loans and deposits under Sections 269SS and 269T. This now includes precise data points such as Nature, Amount, Code Type and changes in flags for cheque/draft repayments, making the reporting much more granular. If even one tag is missing or incorrectly structured, the upload will fail, not due to audit issues, but due to backend incompatibility. These aren’t cosmetic changes; they fundamentally alter the structure and logic of how we report statutory clauses.

- Many of these fields are ‘required’, meaning their absence will result in the file being unaccepted by the portal. Practitioners must therefore not only update their utility but thoroughly review the schema change document before every audit season, because in this digital compliance ecosystem, staying current isn’t optional but is a procedural survival.

According to Soni from Tax2Win these need to get a tax audit done:

You may also like

Chelsea set for Xavi Simons approach as star 'takes action' to secure Prem transfer

Jules Hudson flooded with support as he issues big career announcement

Tata Sons, Tata Trusts Announce ₹500 Crore Memorial And Welfare Trust for Air India Crash Victims

1 common ingredient will make rice taste 'most delicious'

Boats On Streets: Heavy Rain Floods Datia Roads, Water Enters Homes In Low-Lying Areas (VIDEO)