“India Hates To Wait” — Swiggy’s letter to its shareholders for the September quarter declared boldly, splashed in Instamart’s signature blue-orange colours.

Ironic, ain’t it? India hates to wait, but the wait over Swiggy’s profitability continues.

Of course, the tag line screams speed as Swiggy tries to establish that its quick commerce game, Instamart, is making bulls run, while aggressively trying to lead the race to quench India’s intensifying thirst for quick doorstep deliveries. Yet, as the public market investors eye profitability, their wait continues.

In Q2 FY26, Swiggy posted a 74% on-year increase in its net losses, surpassing the INR 1,000 Cr mark, while revenue shot up by 54% to INR 5,561 Cr. On a sequential basis, however, its net loss narrowed by 9% while the top line grew 12%.

As we have noted earlier in Eternal’s case as well, demand for food delivery is plateauing nationwide. Swiggy’s latest quarterly earnings report has further affirmed the trend shift.

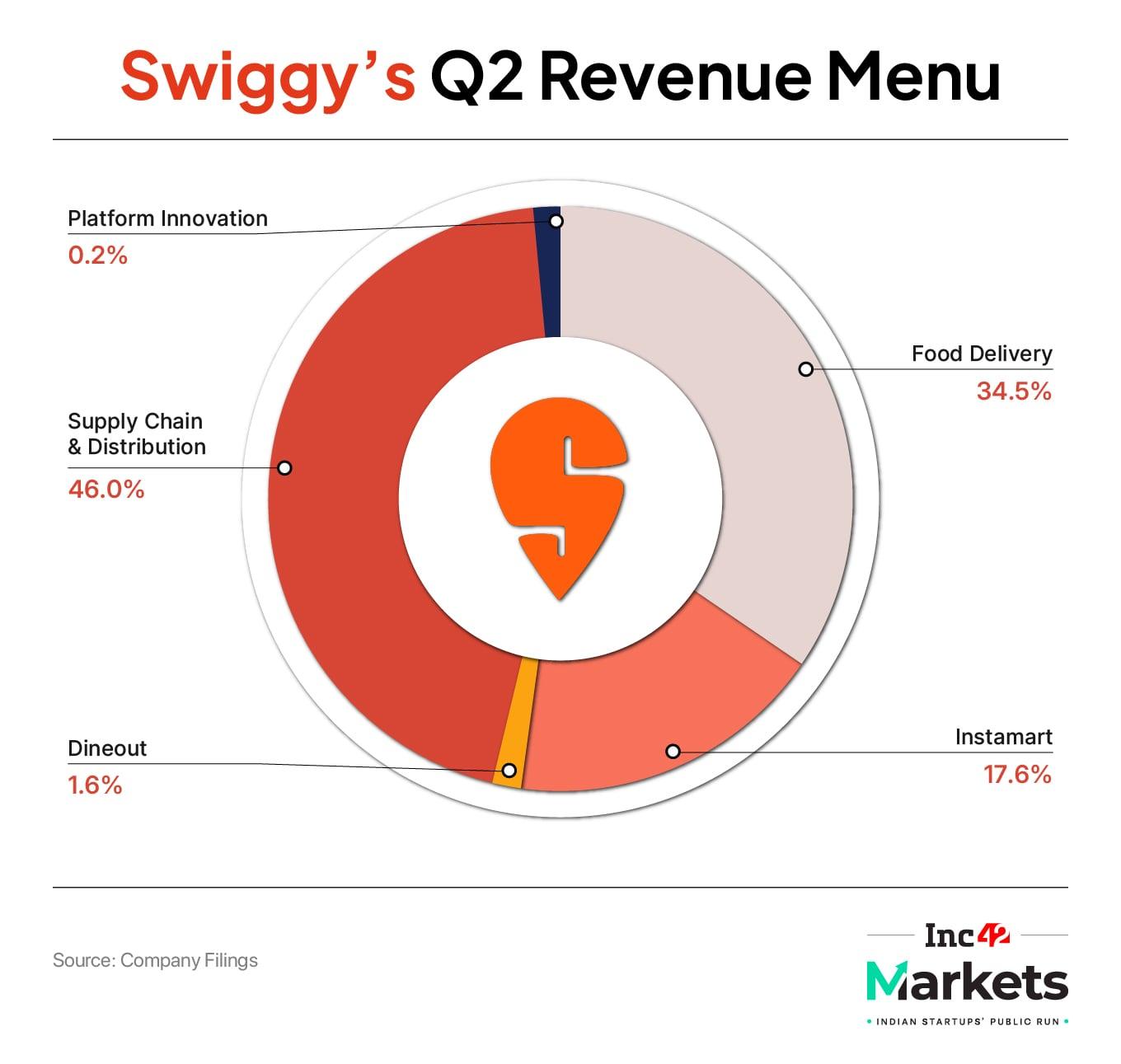

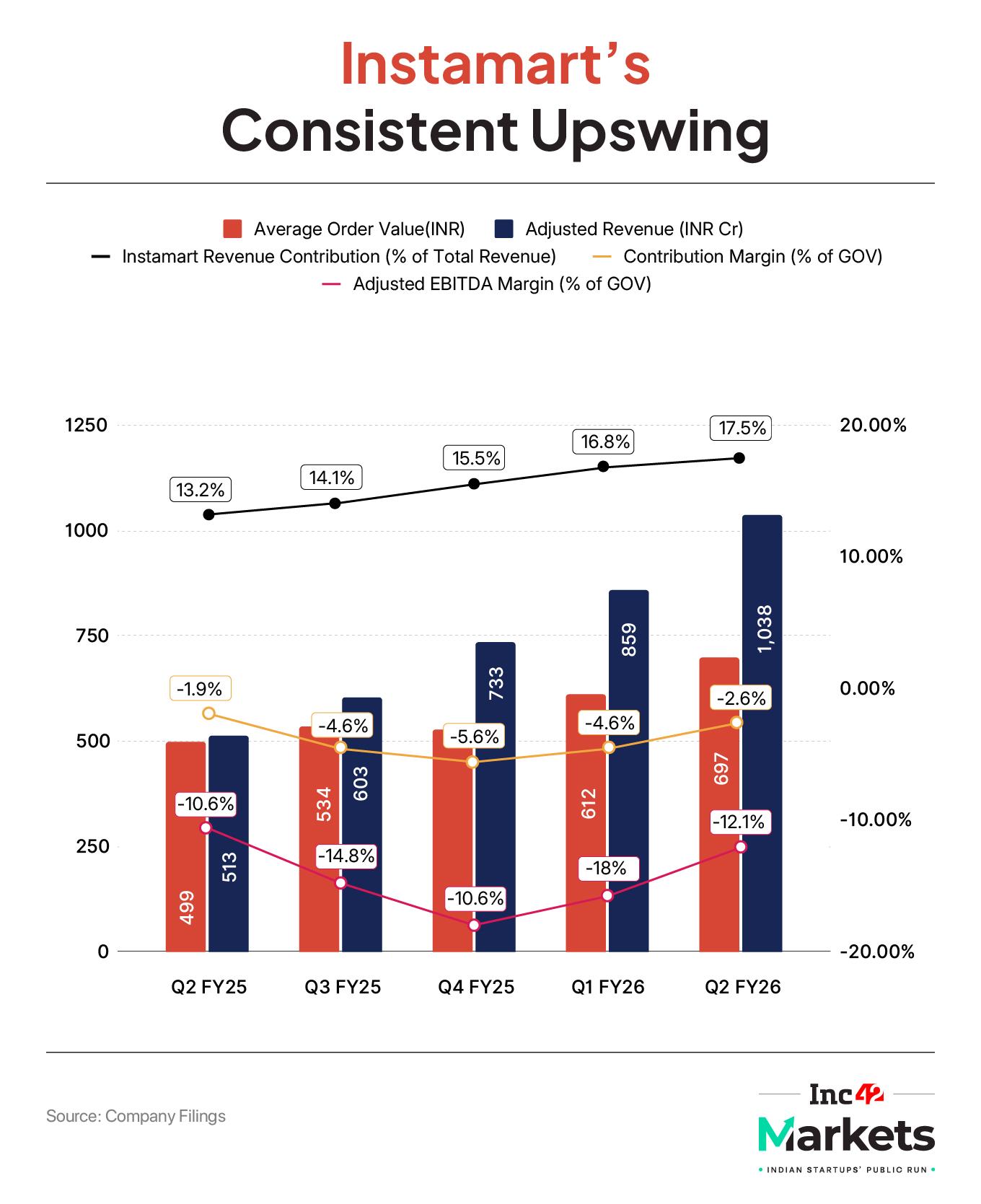

The company’s second growth engine, Instamart, has now begun to shoulder a larger share of the company’s overall revenue. The quick commerce platforms’ contribution has expanded steadily, reaching nearly 18% of total revenue in Q2 FY26, up from 13% a year earlier.

Though food delivery continues to have a larger contribution to its consolidated revenue at 34.5%, it has lowered from almost 44% in the last year’s quarter.

This core vertical, food delivery, which is also profitable, continues to see an increase in its bottomline, which stood at INR 251 Cr in Q2. However, the growth fundamentals are not as steady as quick commerce. Its adjusted revenue saw a marginal increase by 6% to INR 2,206 Cr on a QoQ basis, while its quick commerce arm’s adjusted revenue rose by 21%.

To bolster the Instamart game further, Swiggy is now turning to an inventory-led model like Blinkit and Zepto, which offers more operational benefits compared to the marketplace-based business model.

JM Financial said in its latest report on Swiggy that, despite all the new efforts, including the INR 10,000 Cr fresh fundraising via a qualified institution placement (QIP) to shift to an inventory-led model, investors should be cautious.

“We, however, note that Swiggy’s execution in QC remains unproven (adjusted EBITDA breakeven unlikely to happen before FY29 as per our estimate) and to that extent investors should cautiously turn constructive on the company’s medium- to long-term prospects.”

So, now, as the company keeps Instamart as its top bet, the market’s focus is increasingly turning to this vertical’s execution and path to profitability.

Swiggy Instamart has delivered more than 100% year-on-year (YoY) gross order value (GOV) growth for three consecutive quarters, hitting INR 7,022 Cr in Q2 FY26, a 24.2% QoQ jump, and its fastest quarterly acceleration in three years.

A key driver of this momentum is Instamart’s shift from a narrowly defined grocery service to a broader “everything store”. The platform has widened its stock keeping unit (SKU) base aggressively, expanding into non-grocery categories where pricing, discounting and assortment strategies are tailored to lift basket values and increase purchase frequency.

The result?

Instamart’s average order value rose 40% YoY to INR 697 in Q2. Even on a sequential basis, the number has jumped by 14%.

Swiggy’s launch of MaxxSaver, a cart-consolidation feature earlier this year, has further helped the quick commerce arm increase its AOV. While Blinkit stays ahead of Instamart in most growth numbers, for the first time, Instamart has exceeded the industry leader’s AOV, surpassing Blinkit’s INR 693.

However, if we turn to Instamart’s net order value (NOV) as a percentage of GOV, it stood at 70% in Q2, which implies the vertical’s heavy discounting measures.

To be sure, NOV is determined after excluding discounts from GOV. Hence, both GOV and AOV reflect discounts as well.

“It’s evident that Instamart is doing heavy discounting to attract more customers and to push the GOV growth, but this is not sustainable. That is why they are now raising funds, because Swiggy knows this burn will continue for a few more quarters,” said Datum Intelligence founder Satish Meena.

Even equity markets analyst Ponmudi R, CEO of Enrich Money, noted that the primary drag for Swiggy remains high delivery costs, aggressive discounting, and heavy investment in Instamart’s dark-store network — a segment yet to reach breakeven.

But we can’t deny Swiggy is making efforts to bring costs in check.

Even as Instamart scaled both GOV and AOV, the company kept a tight grip on costs, signaling a deliberate push to grow with profitability and long-term sustainability in mind.

Despite the recent platform fee hikes, Swiggy claims that the total cost of service for users (delivery fee + platform fee + cost of membership programme) has remained 5-6% of AOV over the last 3 years, underpinning its “focus on affordability”.

Swiggy also managed to improve its contribution margin, while contribution losses contracted by nearly one-third to INR 181 Cr. The drop in contribution margin is almost at Q2 FY25 levels, when the quick commerce arm was just doing half of today’s revenue.

This is primarily due to a rise in advertising revenue and an improvement in dark store capacity utilisation.

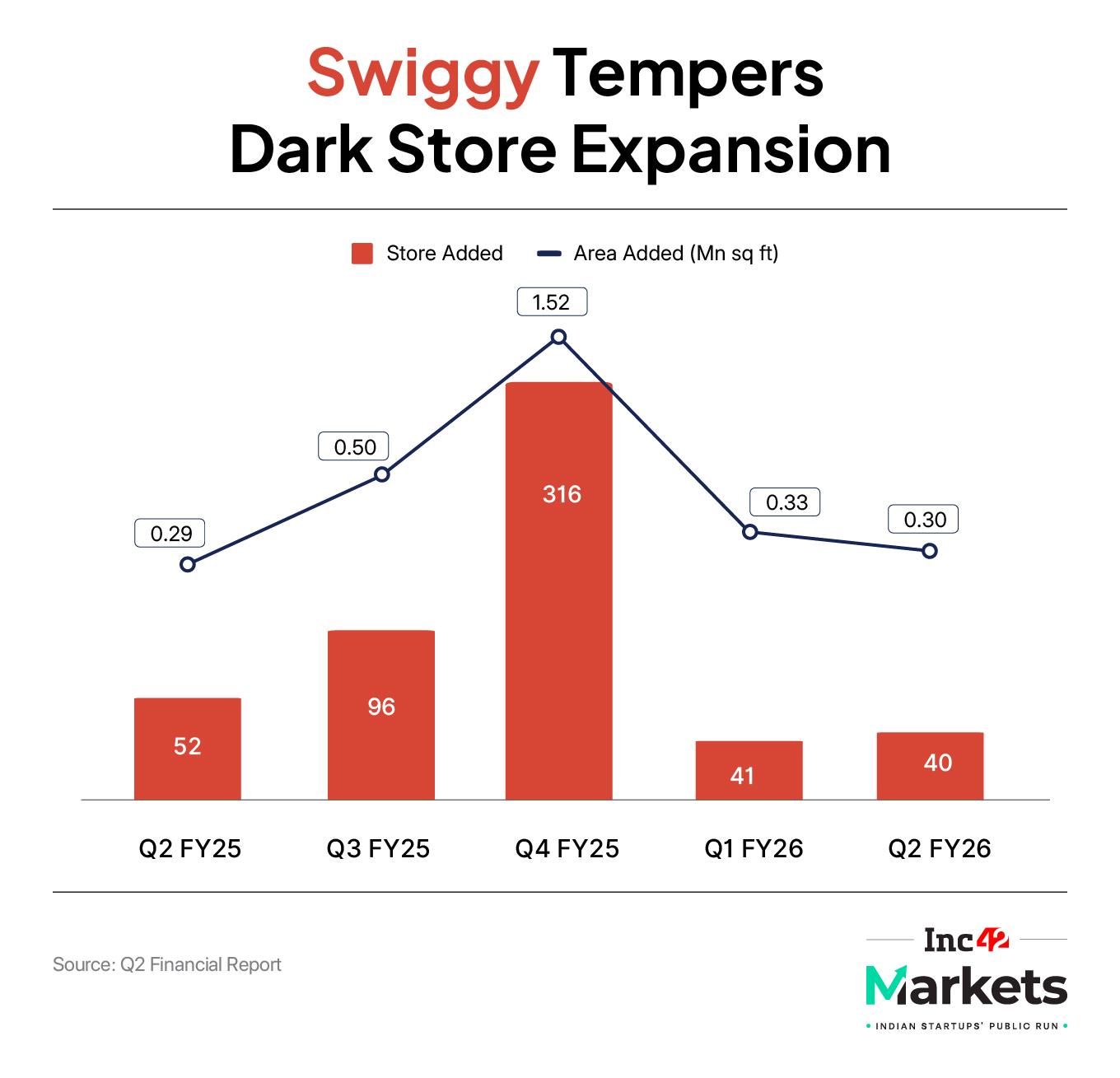

Instamart’s AOV expansion is also tied to its rapid yet increasingly calibrated dark store rollout. After adding stores in the triple digits a few quarters ago, the platform has deliberately slowed its pace, adding just 40 dark stores in Q2. This brings its presence to 128 cities.

However, the shift in strategy reflects a focus on scaling larger megapods. Even as the number of darkstores are in check, Instamart’s overall dark store footprint expanded by another 0.3 Mn sq ft to 4.6 Mn sq ft.

Currently, 25% of Instamart’s dark stores are profitable, up from fewer than 10 just two quarters earlier. Additionally, 50 stores now operate at margins above 3%, with the strongest locations touching 5%.

Instamart is sweating its already established darkstore assets for maximum throughput, deferring aggressive new city additions until existing stores reach their capacity limits. This has resulted in reduction in drag from underperforming stores.

Till last year, before its IPO, Swiggy had spent INR 755 Cr to expand its dark store counts, but the company hasn’t provided another updated figure on that. However, analysts say that while a strategic decision to install megapods is a good step, as it focuses on non-grocery segment as well, it also has challenges.

“Now they need more orders to make these megapods profitable and sustainable. This is like a cycle where again Swiggy has to give deeper discounts to attract more customers,” said Meena, adding that capital investment will also be higher for each megapod.

Despite the underlying cash burn, as of September 2025, Swiggy had INR 4,605 Cr in consolidated cash and equivalents — and is expecting an additional INR 2,400 Cr infusion from the sale of its Rapido stake.

As JM Financials aptly noted, the QIP is likely to fast-track Swiggy’s classification from ‘Foreign-Owned-and-Controlled Company (FOCC)’ to an ‘Indian-Owned-and Controlled Company (IOCC)’.

And for ecommerce places to work in an inventory-led model, it’s a mandate to be an IOCC and have more domestic investors.

As of the quarter ended September 2025, foreign companies alone held a 46.18% stake in Swiggy, besides the other FIIs who held another 23% above stake in the company. This has to change, and Swiggy now needs more Indian investors to run an inventory-led model.

Equity analyst Ponmudi said that by owning inventory, Swiggy gains greater control over stock availability, delivery timelines, and product quality.

“Though this comes with higher upfront expenditure on warehousing, logistics, and working capital, this isn’t a cost misstep, but a strategic pivot from chasing market share to building operational depth.”

If executed effectively, this model can transform Instamart from a cost-heavy division into a long-term profit engine, similar to how Amazon scaled its fulfillment-led approach.

In fact, an inventory-led model is expected to narrow Instamart’s performance gap with Blinkit, whose adjusted revenue has surged sharply, rising 312% QoQ to INR 9,891 Cr in Q2 FY26, underscoring the scalability advantages of holding inventory at scale.

Meanwhile, many Indian retail investors don’t seem to be in the mood to wait, nor do they like the raise and burn business model of a public-listed entity. Following its Q2 results and QIP announcement, Swiggy shares slipped 2.6% during the intraday trading on Friday (October 31). It ended the week at INR 410.05, down nearly 2%.

Rupak De, senior technical analyst at LKP Securities, suggests investors hold the scrip at a stop loss of INR 409 apiece.

While global analysts are largely bullish on Swiggy shares in the long term, the verdict of domestic analysts is clear: Eternal is the flavour of the season, and Swiggy is still cooking. For now, it’s only D-Street’s cautious optimism and wait-and-watch approach that keep Swiggy on the menu.

Markets Watch: New Deals, Results And More- Lenskart’s Day 1 Goes Well: The day 1 of its IPO saw strong investor interest and was subscribed 1.13X, receiving cumulative bids for 11.2 Cr shares. The scrip will be listed on November 10, valuing Lenskart at $8 Bn

- BoAt DRHP Now In Public: Its public offering will comprise a fresh issue of equity shares worth up to INR 500 Cr and an offer-for-sale (OFS) component of up to INR 1,000 Cr

- ixigo Posts Loss In Q2: The travel tech major slipped into the red in Q2 FY26, with a INR net loss of 3.5 Cr as against a net profit of INR 13.1 Cr in the year-ago quarter. Its operating revenue rose 36% YoY to INR 282.7 Cr

- MakeMyTrip’s Also Posts A Loss: The OTA major reported a loss of $5.7 Mn in Q2 against a net profit of $17.9 Mn in last year’s quarter. Topline grew 9% YoY to $229.3 Mn

- Pine Labs’ IPO Opens Next Week: The fintech has filed RHP for its IPO, which will comprise a fresh issue of up to INR 2,080 Cr and OFS of up to 8.23 Cr shares. The IPO will open on November 7 and close on November 11

[Edited By Nikhil Subramaniam]

The post Investors Keep Waiting, Swiggy Yet To Deliver appeared first on Inc42 Media.

You may also like

Jemimah Rodrigues, India Women finally reveal team anthem, coaches join in - watch

Meet former Buddhist Steve Kang, an addict who says he went to 'Christian' hell after a drug overdose

At 92 pc, India's AI adoption rate highest in Asia Pacific: Report

Strictly star shares tearful statement as she's dealt huge blow after live show

Experts suggest nuts and seeds should now be included as part of five a day